Quicken was an online individual funds administration product which can be used to tune transactions and you may perform lender, brokerage, credit card and you may loan accounts, and additionally student education loans. Quicken lets profiles to create a budget, manage bills, and construct discounts desires. To make a spending budget is the initial step for the handling college loans and you will paying down loans fundamentally.

Devices getting Controlling Student loan Obligations which have Quicken

The mortgage Calculator computes monthly loan repayments and you may shows brand new fee plan. It can also estimate the loan count. It product are often used to estimate education loan payments significantly less than Important Installment and you can Prolonged Fees.

Your debt Prevention Planner is actually a cost management unit that can help you pay away from obligations in the course of time and relieve the complete appeal you pay. It offers your having a plan so you can get off financial obligation, according to information regarding all your funds when you look at the Quicken, as well as your college loans. It implements brand new avalanche way for paying off personal debt faster. The brand new avalanche method makes the required costs toward your entire loans and additional repayments to the financing with the large interest rate. The debt Prevention Planner reveals new perception of those extra payments on the financing equilibrium, full appeal repaid in addition to go out brand new money was paid.

Quicken brings a free credit rating, upgraded every quarter. The credit score is founded on the latest VantageScore step 3.0 using Equifax investigation. Which credit score is not necessarily the just like the credit score employed by lenders and work out borrowing behavior. The credit score cost your abilities given that worst, so good, a beneficial and you may advanced along multiple size, such bank card utilize, percentage history, period of borrowing, complete accounts, borrowing inquiries and you may derogatory scratching. This should help you choose how-to alter your fico scores.

Controlling Student loans Manually

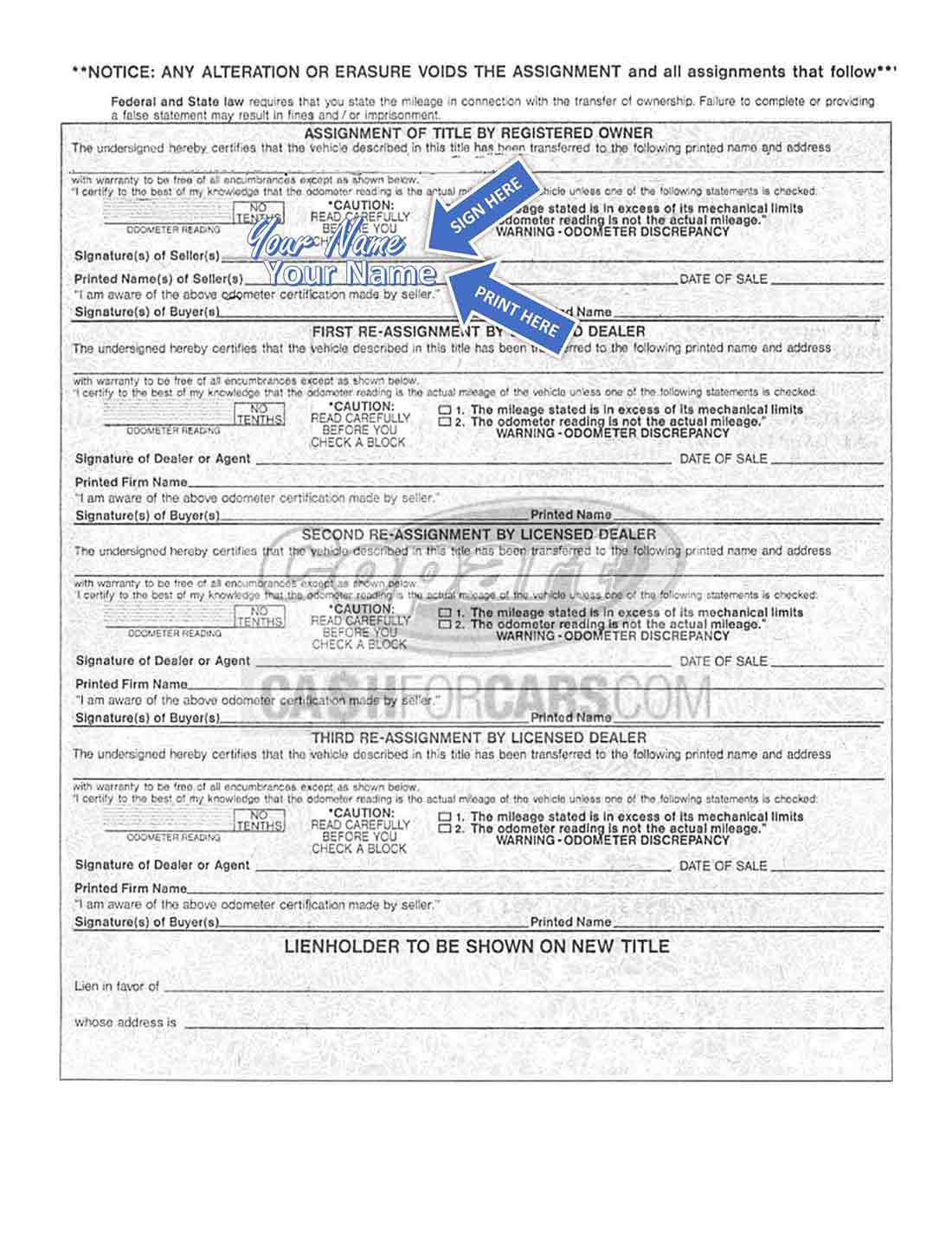

Contain the student loans to help you Quicken yourself, using the Create yet another Mortgage… diet plan solution. Which eating plan http://elitecashadvance.com/installment-loans-in/memphis/ solution lets you specify that loan due to the fact students Financing, as the shown within display screen snapshot.

Although not, student loan accounts in the Quicken do not already manage brand new finished fees and you can income-motivated cost plans, only basic fees and you may extended repayment. The loan money not as much as finished repayment and you will earnings-determined cost will need to be added yourself.

Quicken and doesn’t track exactly how many being qualified repayments to possess consumers who will be functioning on the public-service financing forgiveness.

Linking Quicken to Student loan Loan providers

It can be it is possible to so you’re able to link Quicken to help you federal and private figuratively speaking, according to your specific financing servicer. This directory of mortgage servicers is actually taken from the fresh new FIDIR document throughout the Quicken setting. Introduction from a loan provider in this document does not suggest that the financial currently supporting exchange down load otherwise the financial supports purchase install for student loan account instead of almost every other membership products. The only way to make sure is to try to arrange the fresh new education loan for starters Action Change from inside the Quicken. You may are guaranteeing on the financial or financing servicer.

Though financing servicer aids hooking up having Quicken, it might let you know precisely the borrower’s complete student loan loans, perhaps not anyone funds, even when for every single loan may have another rate of interest.

These servicers from Federal Head Funds are included in the fresh new FIDIR file. Nothing of them mortgage servicers, yet not, bring information about Quicken combination on their web sites.

- Foundation Student loan Service

- FedLoan Upkeep (PHEAA)

- Stone County Government & Res (GSMR)

- Great Lakes Ed Loan Features

- EdFinancial Characteristics

- Navient Finance

- Oklahoma Student loan Authority

- MOHELA Financing

The next loan providers and you will loan servicers aren’t within the Quicken FIDIR file, so they really most likely do not bring hooking up that have Quicken.

When you have any problems otherwise questions, Quicken offers 100 % free mobile phone and you may talk advice. To learn more about Quicken otherwise subscribe, head to the website.

Summation

Quicken can help you ensure you get your funds prepared and construct an effective strategy for paying education loan personal debt and you will getting their most other financial wants. You can attempt Quicken having a thirty-big date chance-trial offer.