- You happen to be a great Canadian resident

- You have been operating complete-returning to about 3 months

- You’ve been care about-used for at least couple of years

- You’re not a past broke

- You have got the absolute minimum credit score off 620

- You happen to be obtaining a mortgage loan number of $50,100000 or higher

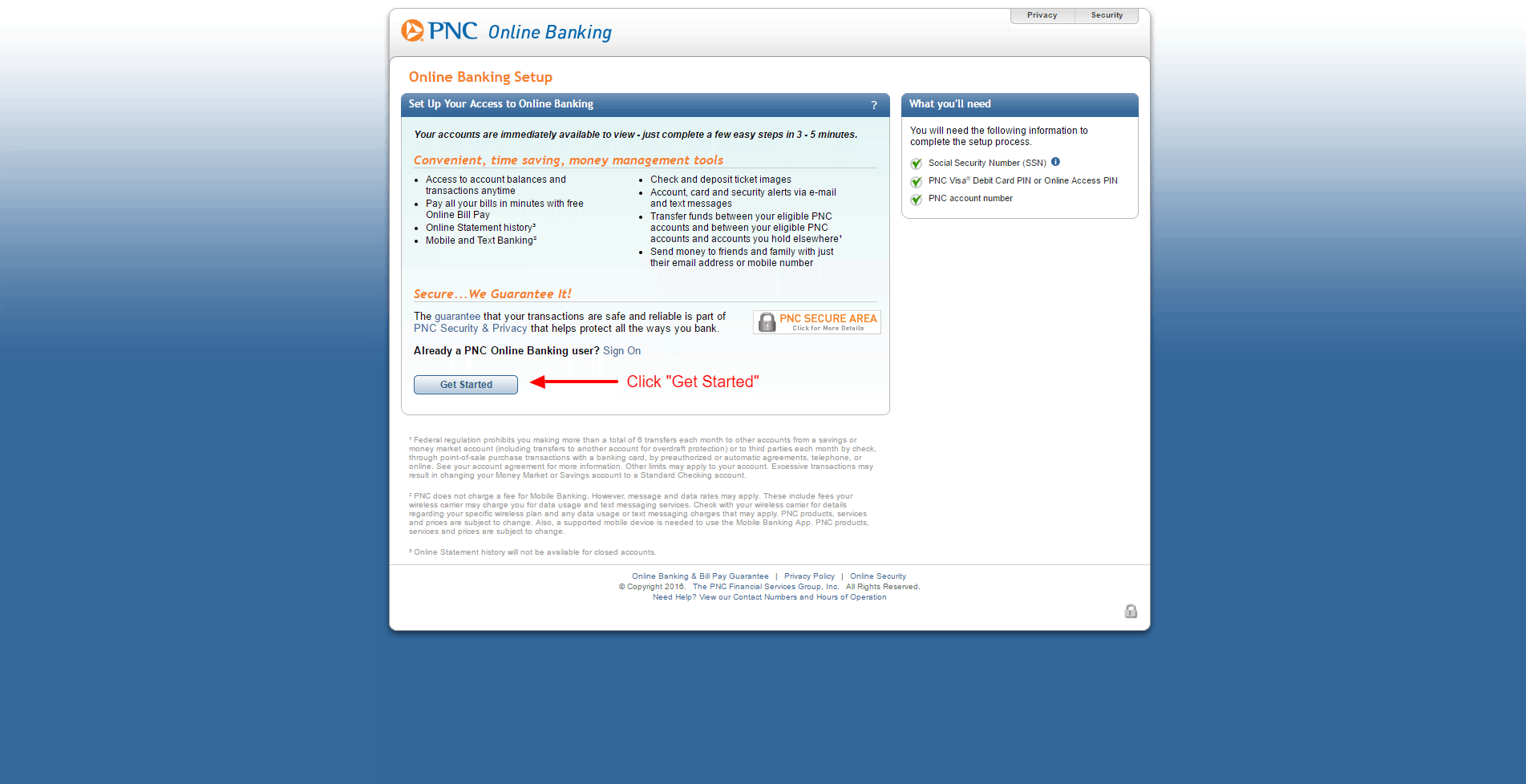

The program techniques is fairly quick. After you use on line, you’ll be assigned home financing broker manager to walk you courtesy it.

Verdict

If you are searching for attractive Canadian fixed mortgage prices having a guaranteed secure ages of 120 weeks , go to Orange. Its a secure electronic banking platform giving your having prepayment benefits all the way to . Additionally, you will rating pointers courtesy dedicated representatives. It’s secure to express Orange is one of the leading labels one of the on the web lenders into the Canada one to stay out.

Canadian Home loan Rates Compared

To phrase it differently, home financing was financing out of a bank or a home loan lender to assist you in the purchasing property. The brand new house serves as a kind of protection for the money you happen to be borrowing.

The audience is here to towards financial-related jargon such home loan types, words, amortization months and. Understand our self-help guide to remain in this new learn about the top-level Canadian lenders :

The brand new Pre-approval Procedure

There are many exactly what you need understand and you may do one which just get fantasy house. Before-going interested in a property to purchase, it seems sensible to track down pre-approved by a lender and that means you rating a concept of how much cash you can afford. A good pre-recognition is a basic part of the loan process, that can covers buyers off threats.

- Experience with the utmost home loan matter you’re qualified to receive

- An excellent secure ages of 60 to help you 130 weeks to your home loan installment loan lender Jacksonville GA rates of interest that you had acknowledged having

You might decide for online home loan rates evaluation so you can measure the sector before getting pre-accepted. When you are getting a reasonable idea of what’s available to you, you’ll find it easier to research rates for the best deals.

You may be purchasing your own home loan till even after your circulate from inside the, thus another great equipment to know about a knowledgeable costs perform feel home financing calculator .

When you get pre-accepted to own a home loan, their conformed-through to speed would be locked in for a period of 60 so you can 130 weeks , according to lender. Today your residence-bing search can start inside earnest!

Assets prices are steep, to put it mildly. All of us don’t have the whole capital to invest in the fantasy homes. Which monthly mortgage loans may be the go-so you’re able to provider. Prior to you could start using mortgage loans, you happen to be necessary to pay the main rates, entitled an advance payment .

Extent you have to pay down was deducted on possessions rate, therefore the large their advance payment , small their mortgage matter. For folks who establish below 20% of the property rate, try to shell out home loan insurance rates.

You happen to be looking for an educated Canadian home loan costs that have low down commission options however, understand that these types of have an added fees real estate loan insurance coverage.

The fresh new and you can resale possessions covered mortgage loans are in fact available from very loan providers. Thus, new carrying will set you back regarding the lowest down payment financial try high than others of a typical home loan since they range from the insurance policies superior.

It is for the best to place down as frequently money as you could potentially as desire costs for a smaller sized home loan is actually straight down, adding up to significant offers along side long run.