- Your own ) However, …

- Interest levels was variable, since they are with a lot of HELOCs They’re going top to bottom toward U.S. Finest Price. In the course of which writing, the fresh new Federal Reserve try planning several speed hikes

- Zero application, origination, otherwise inactivity charges however, there are others. Navy Government claims, “To possess mortgage amounts of to $250,100, closing costs one players must pay generally speaking start around $3 hundred and you may $2,000”

- You can have a beneficial 20-season “draw” months, during which you could potentially use and you may pay off as you would like. However the “repayment” several months kicks in at the beginning of year 21, and after that you is only able to lower your debts, zeroing it because of the year 40.

* Rates of interest cited on Navy Federal’s webpages for the ranged away from 5.00% getting an effective 70% LTV so you’re able to 6.50% getting an effective 95% LTV. Click here to have a larger a number of sample rates. The pace you will be offered are different dependent on your credit rating and existing debt burden. And remember: Speaking of varying costs.

Once more, Navy Federal’s HELOC seems getting an excellent giving. Whenever you are qualified, you should get a quote including ones from other loan providers. Do not be amazed if this sounds like an informed you get.

In just 350 urban centers,186 where are on or near army installment, you’re struggling to come across an effective Navy Government department close your area. But read the web site’s part locator.

Definitely, right now, many mortgage applicants like to really works by mobile phone (1-888-842-6328) otherwise from lender’s web site or application. And Navy Federal do better with all the individuals.

Begin the site towards useful How to Get a home Collateral Loan otherwise Credit line page. You to strolls you through the techniques and goes to your typical timeline.

Navy Federal Borrowing from the bank Commitment Specialist and you will User Feedback

We went to ten websites that give user and you may expert feedback of financial groups. Of those you to definitely gave star evaluations, the typical get try step three.8 off a prospective five.

not, that had only three user recommendations, a couple of out-of disgruntled consumers. If you take aside that little take to, the average across the kept of those try cuatro.54 celebs.

That generally seems to line-up with your take a look at one Navy Federal generally will bring sophisticated customer support. Which can be borne out by its get throughout the J.D. Stamina 2021 You.S. Number 1 Financial Origination Fulfillment StudySM, and this polled 5,414 customers. They came 8th for customer care one of best wishes financial lenders, over the community average.

Obviously, any company which have 11 billion users tend to upset certain. However, Navy Government goes wrong less and you can pleasures many more.

Navy Federal Borrowing Partnership Benefits

- Higher support service

- A general a number of banking goods, together with house guarantee financing and https://www.clickcashadvance.com/loans/parent-loans HELOCs

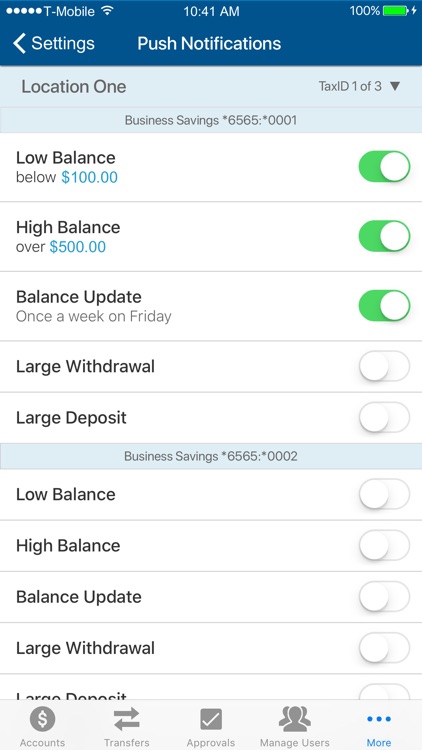

- Highly regarded mobile application and you will powerful web site having great features

Navy Federal Borrowing Union Cons

- Registration isnt offered to all

- Restricted department community

Such wouldn’t bother those individuals entitled to signup except if both live quite a distance of a department and you may hate the new innovation.

Navy Federal Borrowing from the bank Commitment Solutions

Simply because we like brand new Navy Federal Borrowing Relationship household collateral financing and you may HELOC, that will not necessarily mean one of those is perfect for your. It might well churn out by doing this. Nevertheless must make sure.

Rates throughout these activities vary generally ranging from loan providers. And it’s really feasible for you’ll be offered a diminished that by the certainly Navy Federal’s competitors.

Therefore function an excellent shortlist of the many lenders that will be a people. And get for each and every getting a quote. It isn’t difficult up coming to compare your offers hand and hand and you may purchase the deal that is good for you.

- Loan credit limitations range between $ten,100 to help you $five hundred,100000