What you need to Know

- Providing an auto loan which have a deep failing credit rating produces it more complicated to find approved

- The reduced your credit rating, the greater number of lenders tend to cost you to possess vehicle funding

- Improving your credit otherwise dealing with a subprime lender tends to be your best bet getting accepted

Contents

To buy an automible is going to be an exciting sense, particularly when this is your very first automobile, basic the fresh auto or the basic auto you’re to find as opposed to let out of your loved ones.

If you do not can buy your vehicle with bucks, you will probably need an auto loan. Before every vehicle lender decides to make you a car loan, might examine your credit score.

But what for those who have reduced-than-prime borrowing from the bank? Does this indicate you can’t get an automobile? Does it result in the vehicle you dream about expensive?

Delivering an auto loan with less than perfect credit is capable of turning just what you can expect to was in fact an exciting drive off an open roadway on taking caught inside rush-hour site visitors that have an almost blank tank off gasoline.

However, option pathways are available, that assist was waiting for you. Consider this to be your car or truck GPS and you can follow these tips.

Your credit rating was a variety from 3 hundred to help you 850. The higher the get, the greater your credit. In addition to most useful their credit, the much more likely you are to locate less interest.

At exactly the same time, that have a poor credit rating, the financial institution may want to refute your loan app. Whenever they create accept they, these are generally likely probably charge higher interest rates.

According to analysis out-of Experian (one of several large about three credit score enterprises), interest levels for new and you may put vehicles may vary wildly based on the credit history.

When you find yourself rates alter on a regular basis, it’s easy to note that the greatest plunge for the prices goes in the event your credit score drops beneath the 600 diversity.

If for example the rating places your in the subprime classification, you could just qualify for auto loans regarding subprime loan providers who are willing to provide to help you large-chance consumers and you will charges higher rates of interest.

As an example, to own a unique vehicle charging $29,one hundred thousand which have a good forty-eight-week financing, a plunge out of super prime so you can deep subprime will add almost $2 hundred toward payment per month. One to results in several thousand dollars from inside the interest along the life of their car finance.

Understand why You really have Poor credit: Delay

- Skipped or later money

- Playing with an excessive amount of the offered borrowing

- And make plenty of higher sales towards borrowing in the a short period of time

- Asking for so many borrowing from the bank checks more a short period of energy

The new borrower

Often a little personal debt is a great point. If you don’t have one handmade cards otherwise have not borrowed money on the name or do not have monthly bills, you will possibly not features a credit history. It means you have got a reduced otherwise non-existent credit history.

You might enhance so it by building a credit rating. Sign up for a credit card during your financial otherwise local merchandising store, otherwise initiate purchasing brief monthly obligations (such a moving provider membership) alone.

Chronic compared to. situational

When you yourself have a credit rating, lenders have a tendency to figure out why your credit rating is actually lowest. For many who tend to pay bills later or hold a lot from financial obligation, you might be categorized just like the that have habitual less than perfect credit.

On top of that, should your reduced credit rating comes from divorce or separation, disease, sudden unexpected obligations (such as for https://cashadvancecompass.com/loans/web-cash-loans instance scientific debts) or dropping your work, loan providers could see which because a beneficial situational borrowing problem and may also become more forgiving.

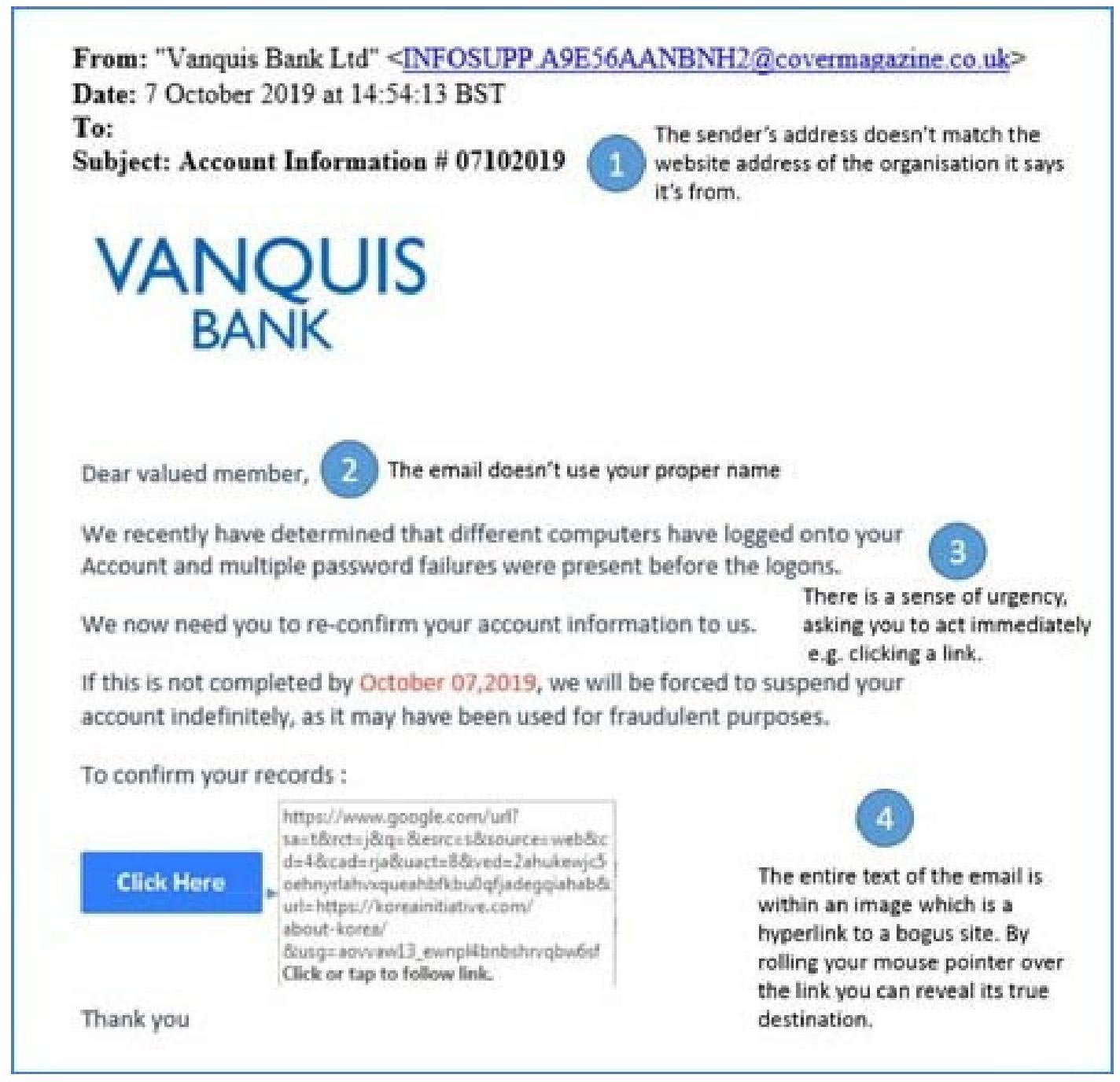

Fraud and you can identity theft & fraud

You are able to fit everything in best and possess good reasonable credit score. If for example the term has been taken and you can anyone is utilizing the credit fraudulently, it will wreck your credit rating.

Thank goodness that you can get your credit rating recovered if you report the trouble into credit agencies.

A 3rd regarding Us citizens have found mistakes within credit reports. Among those problems normally harm your own get. Demand a free of charge credit file to see one warning flag.